January Job Market Report

Key points from the survey:

-

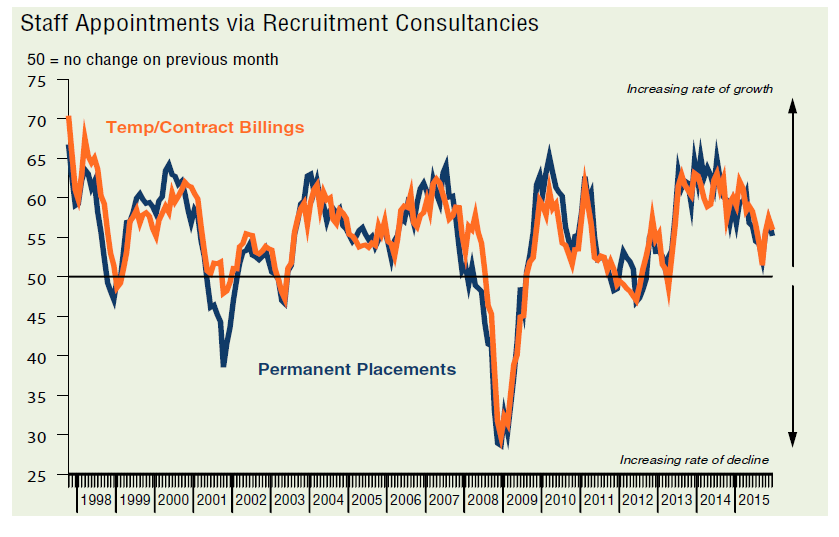

Slower rises in both permanent and temporary staff appointments

-

Permanent salary growth moderates to 26-month low

-

Candidate availability falls at weaker, but still marked, rate

Commenting on the latest survey results, Bernard Brown, Partner at KPMG, said:

“Hiring remained slow but steady during December, with businesses and candidates keen to complete negotiations before Christmas. We are beginning to see a shift away from short term, low risk hiring, with demand for permanent staff outpacing that for temporary workers. This indicates businesses’ confidence is steadily solidifying, leading to an increased willingness to make long term investments in their workforce.”

Growth of staff appointments eases…

The number of people placed in permanent jobs continued to increase in December. After accounting for expected seasonal factors, the index signalled that the rate of expansion remained solid, albeit slower than in November. Panellists commented on rising demand for staff and robust client confidence as factors underpinning the latest increase in placement volumes.

The South posted the fastest growth of permanent staff placements in December, while the slowest rise was seen in London.

Temporary/contract staff billings also increased at a slower pace, with the latest rise also slower than the previous month. Anecdotal evidence from the survey panel linked higher temp billings to rising activity levels at client companies.

…Stronger rise in demand for staff

Vacancies increased at a sharp and accelerated rate in December. Demand for permanent staff continued to rise at a faster pace than that signalled for short-term workers.

The strongest rise was seen for IT & Computing workers with Executive/Professional and Accounting/Financial staff just behind.

Decline in candidate availability eases but still sharp…

The availability of candidates to fill permanent roles continued to decline in December. Although remaining sharp, the rate of deterioration eased since November. Lower permanent staff availability was recorded across each of the four monitored English regions, with the sharpest drop seen in the Midlands.

Temporary/contract staff availability fell further at the end of 2015. Although easing from November’s 18-year record, the rate of deterioration remained considerable. Mirroring the trend for permanent staff, the greatest reduction was seen in the Midlands.

…Pay pressures ease

Salaries awarded to staff placed in permanent jobs increased further in December. However, the rate of growth was the slowest in over two years. Around 21% of panellists reported higher salaries in the latest survey period, compared with approximately 6% that signalled a fall. Those panellists reporting higher salaries generally cited competition for scarce candidates.

Temporary/contract staff hourly pay rates increased at the weakest pace in 21 months.

Feature: Earnings Growth

The UK labour market remained something of an enigma in October. Unemployment fell to a seven-year low but pay growth also eased, once again confounding expectations that a tightening labour market will inevitably drive wages higher. In fact, wage growth is slowing. Average weekly earnings excluding bonuses rose just 2.0% on a year ago in the three months to October, the slowest rate seen since February and down from 2.4% in the three months to September. Even including bonuses, the annual rate fell from 3.0% in the three months to September to 2.4%.

So why isn’t headline pay growth accelerating? It’s not because the average worker who stays in their job feels too insecure to ask for a pay rise. A survey of households in December showed job insecurity at the lowest since data were first collected in 2009. The possible answer is that the renewed weakness of pay growth reflects annual pay reviews that are linked to inflation. With inflation around zero, and even negative in some recent months, it’s not surprising that pay reviews are having a dampening effect on wage growth. However, in some sectors, notably construction where there tends to be a high turnover of staff and where skill shortages are acute, the effect of the tightening labour market is more than offsetting the weakness of annual pay reviews, and average pay growth has accelerated in recent months.