Key points for December:

- Permanent and temporary appointments both increase at sharper rates

- Candidate availability tightens further

- Pay growth remains marked

Faster growth of staff appointments

The number of people placed in permanent jobs increased further in November. The rate of growth was marked, having accelerated to the sharpest since April. Higher placements were recorded at around 38% of panellists, compared with approximately 27% that noted a decline. Anecdotal evidence from recruiters pointed to increased confidence and higher activity levels at client companies.

Growth of permanent placements was broad-based across the monitored English regions during November, with the fastest rate of expansion signalled in the North.

Vacancy growth eases but still strong

Demand for staff continued to rise in November. Although easing to a 29-month low, the rate of expansion remained marked overall. The data also signalled that demand for staff remained considerably stronger in the private sector than the public sector.

Latest official data from the Office for National Statistics (ONS) signalled that vacancies rose 5.3% on an annual basis in the three months to October. That was the slowest growth in three years.

Candidate availability falls at sharper rate

The availability of staff for both permanent and temporary/contract roles fell at sharp and accelerated rates in November with around 44% of panellists reporting a reduction versus less than 7% indicating a rise. All four English regions saw lower levels of permanent staff availability during the latest survey period. The sharpest falls were signalled in the South and London. Shortages of candidates for a range of skill-sets were reported by panellists.

All nine categories of permanent staff registered increased demand in November. The strongest growth was reported for IT & Computing workers, closely followed by Accounting/Financial and Executive/Professional staff.

Pay growth remains marked

Permanent staff salaries continued to rise in November. The latest increase was again strong, with panellists citing competition for qualified staff. Temporary/contract staff hourly pay rates rose at the fastest pace in three months, although growth remained slower than that seen for permanent employees.

Around one-quarter of panellists noted higher salaries, which they attributed to rising demand and shortages of qualified candidates. Higher salaries were indicated in all four English regions; with the Midlands posting the strongest increase overall.

Feature: Labour Market Tightness

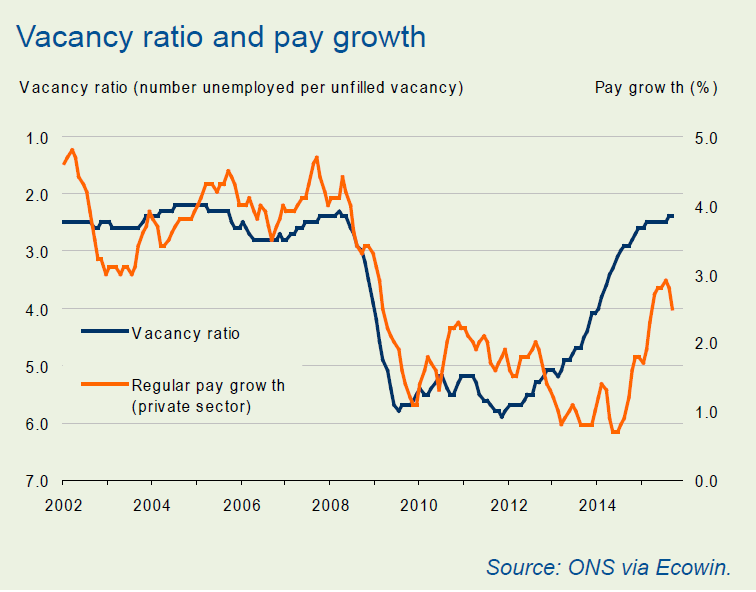

Latest data from the Office for National Statistics (ONS) highlighted a further tightening of UK labour market conditions. The unemployment rate fell to 5.3% in the three months to September, down from 5.4% in the three months to August – the lowest since early-2008.

The actual number of people in unemployment fell by 103,000 in the third quarter compared with the previous quarter. That was the largest drop for a year and left overall unemployment at 1.749 million, the lowest in over seven years.

There are now just 2.4 unemployed people per vacancy, down from a peak of 5.9 four years ago. The current level of the vacancy ratio has in the past been consistent with stronger rates of pay growth than are currently being witnessed, suggesting that an increase in the rate of salary growth may be in store.